The National Cultural Foundation

West Terrace,

St. James, Barbados

246-417-6610

Yes, you can refer to us as the NCF BDD or simply NCF Business.

We see the Cultural Industries as a leading economic driver in Barbados, having the potential to radically change from minor sectors of part time activities to fully operational industries leading in the economic machinery that drives money into our economy.

Via the introduction of economic stimuli, including tax incentives; investment into the industry; increasing export and trade activity for creative goods & services; and working with our partners in facilitating the establishment of Barbadian creative cultural brands for global international and commercial activity.

No, you do not declare grant funding as income on your taxes.

If you receive grant funding, there is a 12 month moratorium before you can apply again. However, the NCF Business Development Department’s mandate is to create sustainable businesses and support sustainable activities so it is hoped that an initial capital injection coupled with business advisory services will negate the need for further and frequent applications.

A cultural practitioner is an individual, company, partnership or unincorporated body that is involved in the business of the arts and cultural industries; has been issued with a licence under section 19; or is registered with a cultural agency.

If you are registering as an individual, you need:

1. EITHER CERTIFIED COPIES OF RELEVANT ACADEMIC CERTIFICATES,

OR A LETTER OF RECOMMENDATION FROM ANY ONE OF THE FOLLOWING:

2. Your TAMIS number

If you are registering as an organization, you need:

Your TAMIS is required for you to access the income tax and duty-free concessions as noted in the Cultural Industries Development Act. Every individual citizien of Barbados and every business that is registered in Barbados is automatically assigned a TAMIS Number and is bound by the tax laws of Barbados. The NCF is NOT the enforcing or governing body for these tax laws and obligations and is not in any way involved in those matters.

Minors will be allowed to register on barbadosartists.bb with the TAMIS number of their Parent or Guardian and the certificate will be valid until age 18. The expiry date will be printed on the certificate.

At age 18, they will be eligible for a TAMIS number and upon presentation of such, will have a new certificate issued bearing their own TAMIS number.

Duty-Free waivers, grants etc. will be issued in care of the parent whose TAMIS number is used.

The Cultural Industries Development Act (available for download HERE) allows for duty free concessions and VAT exemptions on “tools of trade” (i.e. materials and equipment used to create products and services) in your business within the creative sector and cultural industries. These duty-free concessions and VAT exemptions must be tied to a cultural project, a template for which is provided HERE.

Your TAMIS number is required for you to access the income tax and duty-free concessions as noted in the Cultural Industries Development Act. Every individual citizien of Barbados and every business that is registered in Barbados is automatically assigned a TAMIS number and is bound by the tax laws of Barbados. The NCF is NOT the enforcing or governing body for these tax laws and obligations and is not in any way involved in those matters.

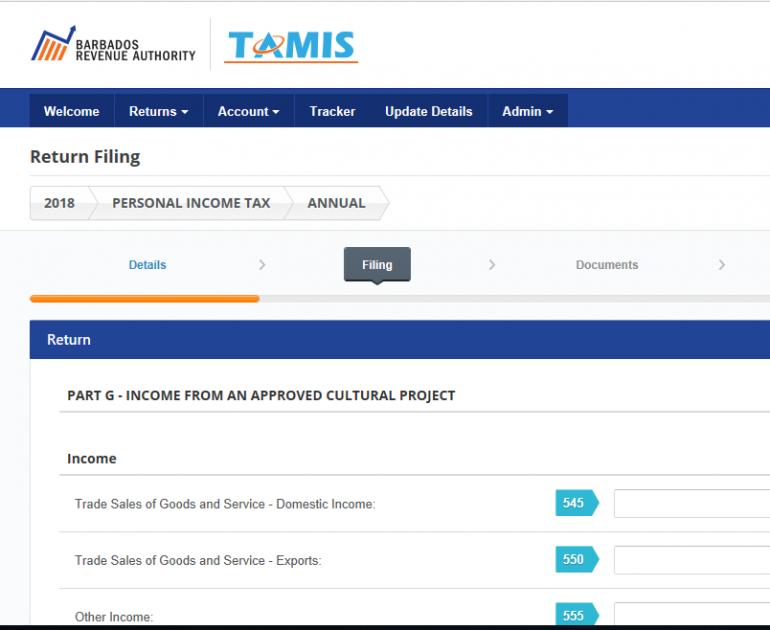

Once you are a registered cultural practitioner (see Registration FAQs for how to become one), you are eligible for tax incentives according to Part V of the Cultural Industries Development Act.

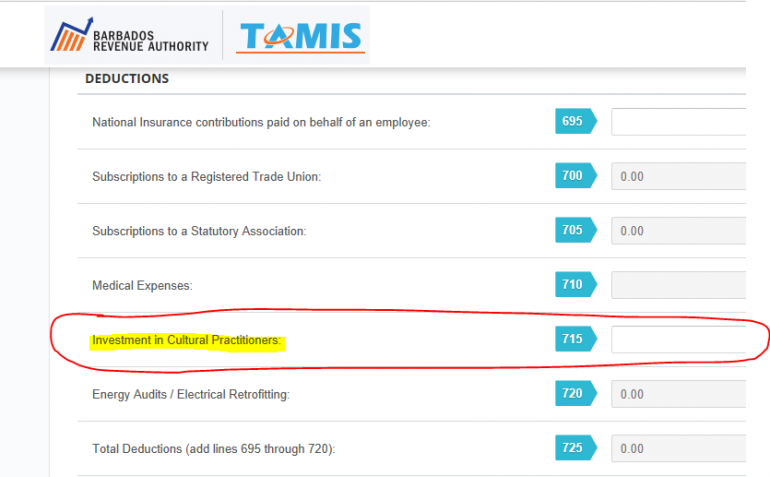

The investment is inputted in Part H under Personal Allowances & Deductions, in the Deductions section at line 715 – pictured below.

No, you do not declare grant funding as income on your taxes.